Paul B Insurance Fundamentals Explained

Associated Subjects One reason insurance policy issues can be so confounding is that the health care market is constantly altering and also the coverage plans used by insurers are difficult to classify. Simply put, the lines between HMOs, PPOs, POSs as well as various other kinds of protection are commonly fuzzy. Still, comprehending the make-up of numerous strategy kinds will be useful in reviewing your alternatives.

PPOs usually use a larger choice of providers than HMOs. Costs may be similar to or somewhat greater than HMOs, and also out-of-pocket expenses are typically higher and a lot more complex than those for HMOs. PPOs permit participants to venture out of the company network at their discretion as well as do not call for a referral from a key treatment doctor.

As soon as the insurance deductible quantity is reached, extra health costs are covered based on the provisions of the wellness insurance policy. For instance, a worker could after that be in charge of 10% of the costs for care gotten from a PPO network provider. Down payments made to an HSA are tax-free to the company and worker, and also cash not spent at the end of the year may be rolled over to pay for future medical costs.

The Single Strategy To Use For Paul B Insurance

(Employer contributions should be the exact same for all workers.) Workers would be accountable for the first $5,000 in medical prices, yet they would certainly each have $3,000 in their individual HSA to pay for medical expenses (and would have a lot more if they, also, added to the HSA). If employees or their households exhaust their $3,000 HSA part, they would certainly pay the following $2,000 expense, whereupon the insurance coverage plan would certainly begin to pay.

There is no limit on the quantity of money a company can contribute to staff member accounts, nevertheless, the accounts may not be moneyed through staff member income deferrals under a snack bar plan. Additionally, companies are not permitted to reimburse any component of the balance to staff members.

Do you understand when the most wonderful time of the year is? The wonderful time of year when you obtain to compare health and wellness insurance policy intends to see which one is right for you! Okay, you obtained us.

Get This Report on Paul B Insurance

When it's time to pick, it's vital to recognize what each strategy covers, just how much it sets you back, and where you can use it? This stuff can feel complicated, but it's easier than it seems. We assembled some practical learning steps to help you really feel certain concerning your alternatives.

Emergency treatment is commonly the exception to the rule. Pro: Most PPOs have a suitable choice of companies to select from in your location.

Disadvantage: Higher costs make PPOs a lot more costly than other sorts of plans like HMOs. A health upkeep organization is a wellness insurance policy plan that usually just covers care from medical professionals who benefit (or agreement with) that particular strategy.3 So unless there's an emergency, your strategy will not spend for out-of-network care.

The Only Guide to Paul B Insurance

Even More like Michael Phelps. It's great to know that strategies in every category give some types of complimentary preventive treatment, and some offer complimentary or reduced healthcare services before you satisfy your deductible.

Bronze plans have the most affordable regular monthly costs yet the greatest out-of-pocket costs. As you function your means up with the Silver, Gold as well as Platinum classifications, you pay much more in costs, yet less in deductibles as well as coinsurance. But as we mentioned in the past, the added expenses in the Silver classification can be decreased if you receive the cost-sharing decreases.

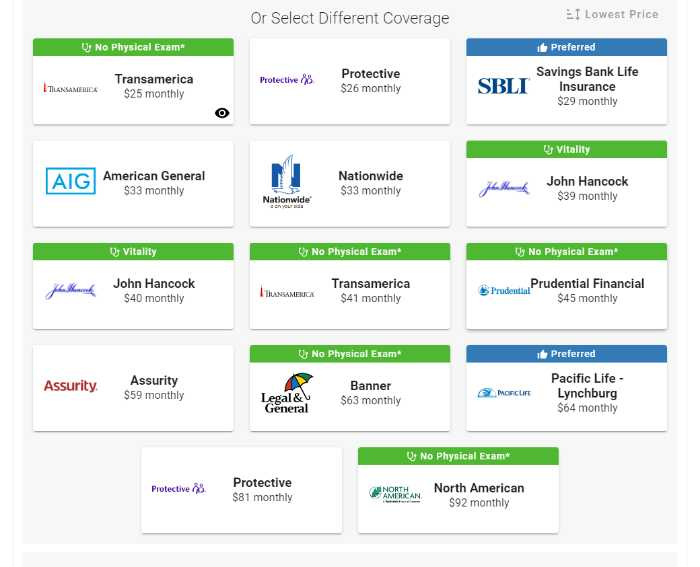

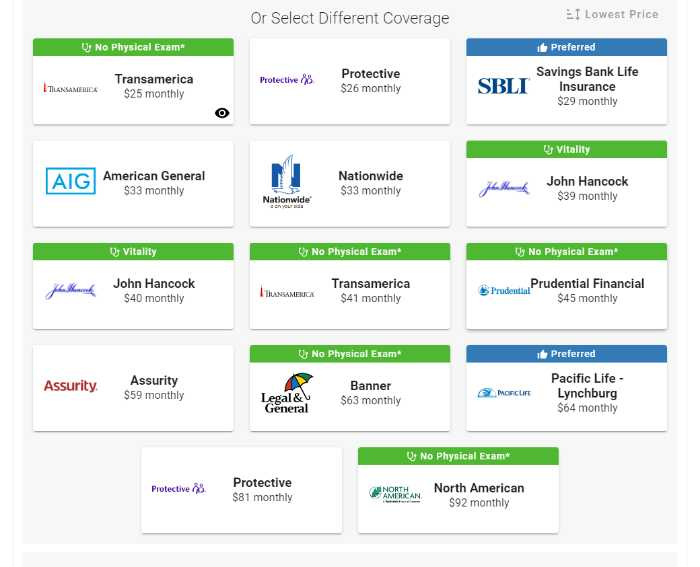

Decreases can reduce your out-of-pocket health care costs a great deal, so obtain with among our Supported Local Carriers (ELPs) who can help you discover what you might be qualified for. The table below shows the percent that the insurance company paysand what you payfor covered costs after you meet your insurance deductible in each plan classification.

See This Report about Paul B Insurance

Other costs, usually called "out-of-pocket" expenses, can include up promptly. Things like your insurance deductible, your copay, your coinsurance quantity and also your out-of-pocket maximum can have a huge effect on the overall cost. Below are some expenses to hug tabs on: Insurance deductible the amount you pay before your insurance business pays anything (besides free preventative treatment) hop over to here Copay a set quantity you pay each time for points like physician visits or other solutions Coinsurance - the portion Get the facts of healthcare services you are browse this site accountable for paying after you've struck your insurance deductible for the year Out-of-pocket optimum the yearly restriction of what you're accountable for paying on your own One of the most effective ways to conserve cash on medical insurance is to utilize a high-deductible health insurance plan (HDHP), particularly if you do not expect to consistently make use of clinical solutions.

These work quite a lot like the other health and wellness insurance policy programs we described already, yet technically they're not a kind of insurance.

If you're trying the do it yourself course as well as have any kind of sticking around questions regarding wellness insurance policy plans, the experts are the ones to ask. And they'll do greater than simply address your questionsthey'll likewise find you the ideal price! Or possibly you 'd like a way to combine obtaining excellent medical care insurance coverage with the opportunity to aid others in a time of demand.

How Paul B Insurance can Save You Time, Stress, and Money.

Our trusted partner Christian Health care Ministries (CHM) can assist you find out your choices. CHM helps family members share healthcare expenses like clinical tests, maternal, a hospital stay as well as surgical treatment. Countless individuals in all 50 states have made use of CHM to cover their healthcare needs. Plus, they're a Ramsey, Relied on companion, so you understand they'll cover the clinical costs they're supposed to and honor your insurance coverage.

Secret Concern 2 One of the important things healthcare reform has actually performed in the U.S. (under the Affordable Care Act) is to present more standardization to insurance policy plan benefits. Prior to such standardization, the advantages supplied diverse considerably from plan to plan. Some plans covered prescriptions, others did not.